Conflicting Theories Of Capital Market Efficiency: A Reassessment Of The Evidential Corpora (2008)

The issue of capital market efficiency is of optimum importance with far-reaching implications for academia as well as for industry. This research study has attempted to critically reassess the controversy surrounding the efficiency of capital markets with specific reference to the Efficient Markets Hypothesis (EMH) and Behavioural Finance. The evidential corpora concerning these two conflicting theories have been reassessed in order to ascertain the possibility and level of efficiency inherent within the capital markets.

Moreover, the two theories have been critically appraised in order to explore the extent to which Behavioural Finance has been seen to undermine the theory of efficient markets. These objectives have been achieved by using a multi-perspectival discourse analytical approach as a research method to deconstruct secondary documentary data. In the final analysis a reconciliatory approach to the dissonance between the EMH and Behavioural Finance is explored with a view to opening up a new dimension to the understanding of market behaviour.

It has been concluded that although the insights from Behavioural Finance have considerably undermined the notion of capital market efficiency, however capital markets have been found to be neither highly efficient nor totally inefficient thus resulting in an ambivalent answer to the question of market efficiency. In the end it is aspired that this undertaking will play an important part in helping to identify, and thus better understand the influential dynamics behind the informational efficiency of capital markets.

- 21,000 words – 85 pages in length

- Outstanding use of literature

- Excellent in depth analysis

- Professional written throughout

- Ideal for finance accounting students

1 – Introduction

A Historical Overview of Capital Market Efficiency

Research Questions and Objectives

Purpose and Outline of the Proposed Study

2 – Literature Review

Conflicting Theories of Capital Market Efficiency

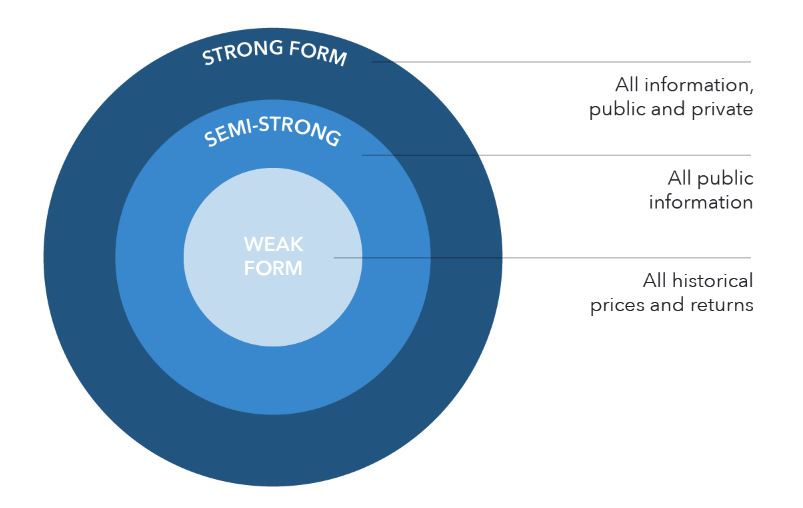

The Efficient Markets Hypothesis (EMH)

Empirical evidence of market efficiency

Tests of weak form efficiency

Tests of semi-strong form efficiency

Tests of strong form efficiency

Empirical Evidence of Anomalous Stock Market Behaviour

Behavioural Finance

Investor Rationality

3 – Research Methodology

Research and Research Methodology

Types of Research Methodology

Research Methods

Quantitative Methods

Qualitative Methods

Differences between Quantitative and Qualitative Research Methods

Research Design

Purpose of the Research Enquiry

Methods of Data Collection

Secondary Data

Methods of Data Analysis

Discourse Analytical Approach

Critical Discourse Analysis (CDA)

Historical Discourse Analysis (HDA)

Intertextual Analysis (ITA)

Justifications for the Selected Research Methodology and Design

Limitations and Difficulties of the proposed Study

4 – Analysis of Data

Conflicting Theories of Capital Market Efficiency

The Efficient Markets Hypothesis vs. Behavioural Finance

Reassessing Theoretical Controversies

Investor Rationality vs. Investor Psychology

Riskless Arbitrage vs. Limits to Arbitrage

Reassessing Empirical Conflicts

Stock Return Unpredictability vs. Anomalous Market Behaviour

Behavioural Finance as a Quasi-Panacea

A Reconciliatory Approach to Capital Market Efficiency

The Adaptive Markets Hypothesis (AMH)

5 – Conclusions, Recommendations and Reflections

Conclusions regarding the Research Questions

Recommendations

Implications for Theory and Practice

Reflections

Bibliography

References