Credit Risk Regulation: Do UK Banks Comply With Basel II? (2008)

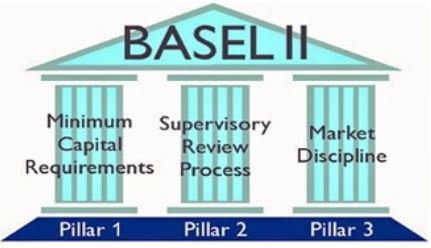

Credit risk is an inherent part of the banking business. There are different classifications of the credit risk. However, the two major sources of its exposures in the financial institutions are the borrower’s default and the downgrade in the counterparty’s credit rating. Starting from the year 2008 internationally active European banks are obliged to manage their credit risks in accordance with Basel II.

Basel II allows the banks to implement one of the three approaches to calculate their credit risk exposures and, hence, determine the amount of the regulatory capital they are required to hold. In the United Kingdom the Financial Services Authority regulates banks to comply with the Basel Committee’s standards and imposes additional capital requirements on them depending on the quality of their loans and risk management systems. This study investigates whether UK banks comply with Basel II by analysing a sample of the country’s Top 5 banks.

The dissertation determines that despite the existence of various incentives for the regulation violations and significant challenges in the implementation of the new standards, the examined banks comply with the Basel II capital adequacy requirements and, moreover, their capital reserves are significantly higher than those established by the Second Accord.

Finally, the examination of the relationship between the capital requirements and the level of commercial and industrial lending in the banks with the certain assumptions allows to state that the increase in the capital charges motivates the banks to enhance their higher risk investments even when the overall portfolio of assets doesn’t grow significantly. Moreover, with regard to three banks under consideration, a sharp increase in the amount of regulatory capital leading to additional ordinary share issues has been uncovered.

- 10,000 words – 75 pages in length

- Excellent use of literature

- Good in depth analysis

- Excellent use of statistics

- Well written throughout

- Ideal for finance and business students

1: Introduction

Motivation for the Research

The Research Objectives

Chapter Outline

2: Literature Review

Credit Risk: Definition and Sources

The Bank for International Settlements’ Regulation of Credit Risk Management

Challenges of the Basel Ii Implementation

The Financial Services Authority Regulation of the Credit Risk Capital Adequacy Requirements

Banks’ Incentives for the Violation of the Capital Adequacy Requirements

3: Methods and Methodology

Research Philosophy and Approach

Methodology

Type of Analysis

Type of Data

Ethics

Hypothesis and Research Question

Hypothesis

Question

Research Method

Methods of Analysis

Method Quality

Secondary Data Collection Method

Sample

Limitations

4: Findings and Analysis

Sample

Capital Ratio Analysis

The Influence of Regulatory Capital on the Banks’ Levels of Commercial and Industrial Lending

Capital Requirements and Shareholders’ Equity

5: Conclusion

Implications of the Research

Limitations

Areas for Future Research

Reference List

Bibliography