External Finance and Firm Performance – Evidence From China

External Finance and Firm Performance Dissertation – The important role that financial institutions play in promoting firm growth and firm performance has been demonstrated by substantial empirical research based on both cross-country and within-country studies. However, firms have achieved considerable success in many developing economies where the financial sector is far from established. The experience of China’s economic development seems to present a counter-example to the literature on financial institutions and development.

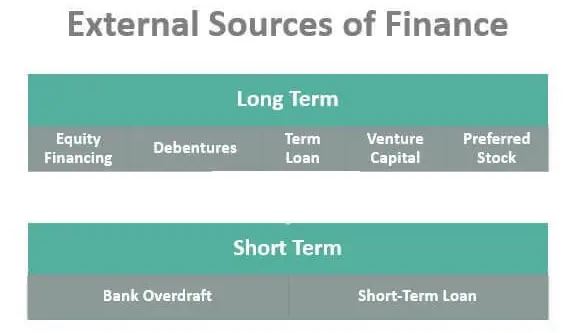

Despite inadequacies in the country’s formal financial institutions such as banks and stock markets, China has been one of the fastest growing economies in the world. This appears to suggest that alternative channels of finance have been a substitute for formal financial systems and supported the rapid development of China’s firms. One widely suggested mechanism in the literature is that firms in developing economies such as China rely to a large degree on alternative external financing, such as trade credit and foreign capital.

However, an assessment of this argument in the literature reveals a shortage of systematic and rigorous empirical studies. In this study, the impacts of alternative external financing (in the form of trade credits and foreign capital) on firm growth rates and performance are analyzed by using data from a survey on firms’ investment and business environment in China conducted by the World Bank in early-2003.

- 12,000 words – 90 pages in length

- Good use of literature

- Good in depth analysis

- Well written throughout

- Ideal for business students

Introduction

Literature Review

The role of financial institutions

China’s experiences

Data and Variables

Empirical Analysis

Benchmark

Main Results

Relevance Condition

Exclusion Restriction

Robustness Checks

Alternative Identification Strategy

Outliers

Sub-Samples

Discussion

Foreign Ownership and Firm Productivity: Causality and Channels Introduction and Literature Review

Data and Variables

Empirical Analysis

Empirical Strategy

Does Foreign Ownership Boost Firm Productivity?

Which Types of Foreign Ownership Matter?

How Does Foreign Ownership Affect Firm Productivity?

Conclusion

References