Location Determinants of Foreign Direct Investment in Real Estate

Determinants of Foreign Direct Investment Dissertation – The global real estate market is complexly structured and highly competitive. In order to diversify the portfolio and to achieve the highest risk adjusted return, real estate firms invest across national borders. The choice of the most favourable location is of highest importance for the success of the investment. This study analyses determinants for the location decision in FDI in real estate. Based on Dunning’s Eclectic Paradigm five determinants have been tested.

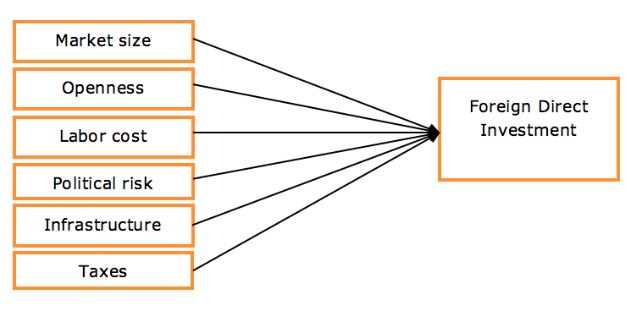

As Dunning refers to FDI over all industries this study enlarges the scope by real estate specific considerations. Different aspects of direct real estate investment are discussed and added to Dunning’s theory. The study shows that mainly economic factors of the local market, the availability of resources, production costs, political conditions as well as cultural aspects influence the choice of a location. More precisely, the infrastructure, the growth of population, the degree of education, the productivity, the country risk and the degree of long-term orientation of the host economy are primarily relevant when the decision in favour of a location for FDI in real estate is made.

The indicators give a good idea of location decision-making in the real estate industry. However, it follows from the results that firm specific strategic considerations are of high relevance to the investor and influence the decision more than the analysed determinants. Risks are found to be less important as multinationals have access to global financial markets and can hedge capital and economic risks as well as translation and transaction exposures.

- 10,000 words – 65 pages in length

- Excellent use of literature

- Good in depth analysis

- Well written throughout

- Ideal for finance and investment students

1 – Introduction

Research Purpose and Objectives

Setting the Scene

Outline of the Study

2 – Literature Review

Motives for FDI

The Eclectic Paradigm

Locational Determinants of Foreign Direct Investment

Hypothesis

3 – Methodology

Method of Analysis

Data Collection Method

Data Basis

Constraints of the Research

4 – Results

Market

Resources

Production Costs

Political Conditions

Cultural and Linguistic Affinities

5 – Analysis and Discussion

Markets

Resources

Production Costs

Political Conditions

Cultural and Linguistic Affinities

6 – Conclusion

References

Appendix Section