The Future Of Securitisation. Is Securitisation History? Its Impact And Influence On The Banking Sector

Securitisation and the Banking Sector Dissertation – This dissertation investigates the various aspects of securitization, aiming to give a comprehensive understanding of the issues evolving around it. The study here focuses on the advantages and disadvantages of securitization, which according to some has been the root cause or at the core of the current global financial turmoil. Asset backed securitization originated in the US in 1968 and subsequently attracted European countries to embrace it.

Ever since has seen an unprecedented growth in its usage. Realising the potential, many institutions adopted the securitization as a model, however now many institutions have now found their fingers burnt in the very process which was yielding high returns. The purpose of this report is also to analyse and reflect upon the future of Securitization and aspects of how the financial institutions, especially banking sector would evolve in the medium to long term.

- 15,000 words – 70 pages in length

- Excellent use of literature

- Expertly written throughout

- Good in depth analysis

- Outstanding MBA dissertation

- Ideal for finance and business students

1: Introduction

2: Research Methodology

Research Objective

Research Methods

Qualitative Research

3: Overview to Securitisation

History

Character and Nature of Securitisation

Why Securitise Assets

Lower Cost of Funding

An Efficient Funding Instrument

Increases Liquidity

Improving Balance Sheet Structure

Drawbacks of Securitisation

Market Risk

Credit Risk

Default Risk

Prepayment Risk

Liquidity Risk

Types of Securitisation

Asset Backed Securities (ABS)

Collateralized Debt Obligations (CDO)

CDE Ratings and Risks

Commercial Mortgage Backed Securities (CMBS)

Residential Mortgage Backed Securities (MBS)

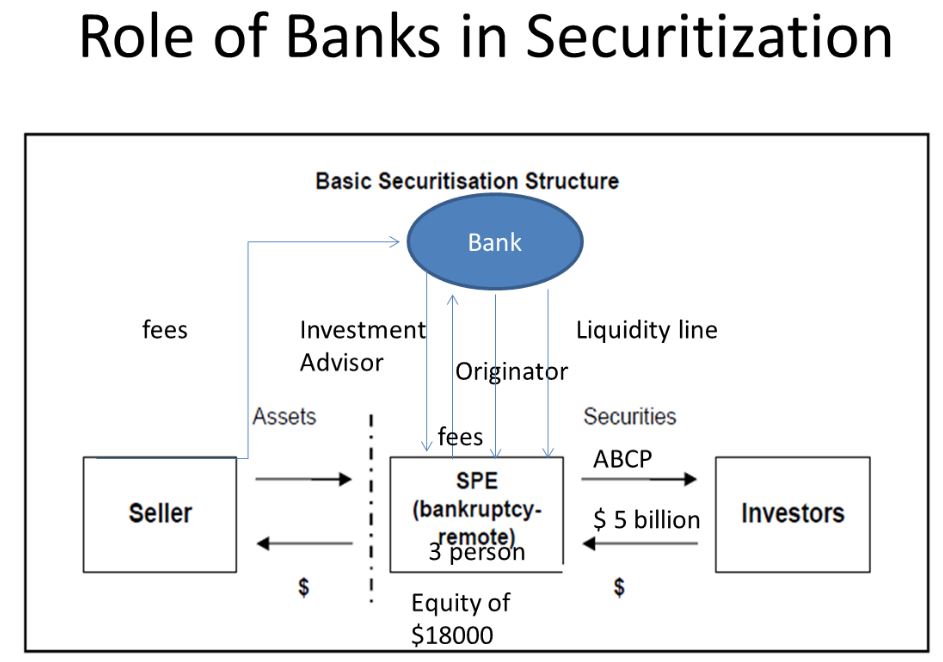

Structure of Securitised Asset

4: Case Studies

Case Study – Northern Rock

Background & History

Northern Rock and Securitization

Funding Crisis at Northern Rock

Summary

Case Study – Bear Stearns

Introduction

History

Bear Stearns and Securitisations

Conclusion

5: The Impact and Future

The Impact of Credit Crunch on the Banking and Financial Sector

How Did the Impact Spread?

The Impact and Future of the Banks

Increased Role of Regulatory Authorities

Capital Adequacy

Leverage Ratios

Accounting Disclosure

Transparency and Senior Management Compensation

Role of Sovereign Funds and Wealthy Investors

Emergence of the Universal Bank

Shift towards the Eastern Developing Economies

The Impact and Future of Securitisation

Securitisation Failed To Diversify or Disperse the Risk Effectively

Securitisation Degrades the Credit Quality

Role of Credit Rating Agencies

Conclusion

Appendix Section

Referencing