An Examination into the Benefits of Risk Management on Investments and Portfolio Assets (2012)

Portfolio Management Benefits Dissertation – A financial investment, contrary to a real investment which involves tangible assets such as land or factories, is an allocation of money with contracts whose values are supposed to increase over time. Therefore, a security is a contract to receive prospective benefits under stated conditions like stocks or bonds. The two main attributes that distinguish securities are time and risk. Usually, the interest rate or rate of return is defined as the gain or loss of the investment divided by the initial value of the investment.

An investment always contains some sort of risk. Therefore, the higher an investor considers the risk of a security, the higher the rate of return or premium the investor demands. The financial assets can be divided into two categories i.e., traditional and alternative investments. The main traditional assets are cash, fixed-income securities, and stocks. For short-term borrowing, governments and corporations issue securities with a year or less to maturity. This market, where governments and corporations manage their short-term cash needs, is called money market.

Two important money market interest rates are the London Interbank Offered Rate (LIBOR) and the interest rate on Treasury Bills. The long-term borrowing needs of corporations and governments are met by issuing bonds. A bond contract provides periodic coupon payments and redemption value at maturity to the bondholder.

Bonds are either traded over-the-counter or in secondary bond markets. Stocks are issued by corporations, which convey rights to the owner. The stock owners elect the board of directors and have claims on the earnings of the company. The stock holders are compensated with cash dividends, whose amount is determined by the board of directors. Public trading of stocks (shares) is regulated by the government. The process of arranging the public sale of stocks of a private firm is called initial public offering (IPO). In this context, privately held stocks are referred to as private equity.

Real estate investments are also usually found in institutional portfolios, either direct or indirect via investment trusts. Since the end of the Bretton-Woods agreement for fixed exchange rates in 1973, foreign exchange or derivatives on foreign exchange rates are also found in portfolios. This is usually the case for international investors who want to hedge against currency risks. As alternative investments we consider hedge funds, managed futures, private equity, physical assets (e.g. commodities), and securitized products (e.g. mortgages).

- 15,000 words – 70 pages in length

- Good use of literature

- Well written throughout

- Good in depth analysis

- Includes questionnaire

- Ideal for finance students

1. Introduction

2. Literature Review

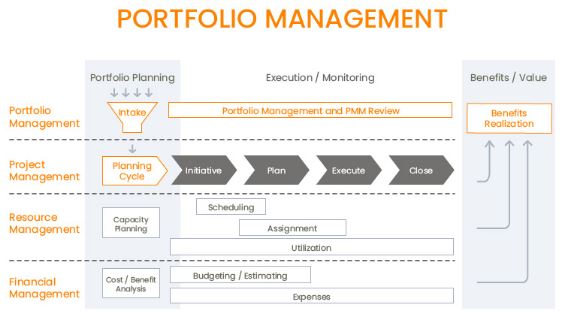

Portfolio Management

Why Portfolio Management?

Benefits Of The Portfolio Management Program

Risk Management And Measures

Types Of Risk

Systematic Risk

Unsystematic Risk

Credit/Default Risk

Country Risk

Foreign Exchange Risk

Interest Rate Risk

Reinvestment Rate Risk

Liquidity Risk

Political Risk

Market Risk

Price Risk

Inflation Risk (Purchasing Power Risk)

Business Risk

Determining The Risk Return Trade-Off

3. Theories Of Investment

Modern Portfolio Theory

Capital Asset Pricing Model

Assumptions of CAPM

Shortcomings of CAPM

Beta

Portfolio Construction

Determining The Appropriate Asset Allocation

Achieving The Portfolio Designed In Step

Reassessing Portfolio Weightings

Rebalancing Strategically

Importance Of Diversification

4. Modes Of Investment

Asset

Fixed Assets

Assets

Other Assets

Security

Debt

Equity

Hybrid

Preference Shares

Convertibles

Equity Warrants

The Securities Market

Public Offer And Private Placement

Bonds

Debentures

Types Of Debentures

Mutual Funds

Types Of Mutual Funds

Insurance

Types Of Insurance

Gold

The Returns From Gold

Gold Prices In India

How To Buy Gold

Tax Implications

The Prospects For Gold

Real Estate

Scenario In India

Why Invest In Indian Real Estate?

Pitfalls That May Be Encountered

Art

5. Asset Selection And Risk Profiling

The Asset Selection Decision

Risk Profiling

Time Horizon

Bankroll

Investment Risk Pyramid

Tier 1 – Base Of The Pyramid

Tier 2 – Middle Portion

Tier 3 – Summit

6. Research Methodology

Sampling

Sample Size

Type Of Sampling

Method Of Data Collection

Primary Data

Secondary Data

7. Findings And Analysis

Based On The Risk Profile Of The Investor

Moderate Risk Profile

High Risk Profile

Very High Risk

Plan Your Portfolio

Growth Portfolio

Conservative Portfolio

Balanced Portfolio

Short Term Portfolio

8. Conclusion

Assess Yourself

Try To Understand Where The Money Is Going

Don’t Rush In Picking Funds, Think First

Invest Don’t Speculate

Don’t Put All The Eggs In One Basket

Be Regular

Do Your Homework

Find The Right Investments

Keep Track Of Your Investments

Know When To Sell Your Investment

Bibliography

Appendices