Determinants of Bank Profitability in South Africa (2016)

Determinants of Bank Profitability Dissertation – The prime rationale for conducting the research is to find the factors that affect the bank’s profitability in the South African region so that appropriate measures can be taken to improve the financial performance. This research provides empirical evidence based on the analysis of the bank’s real financial data in support of the determinants of the bank’s profitability. Thus, this research is considered to be useful in enhancing the knowledge of the bank professionals, as well as the students pursuing higher studies in finance and banking.

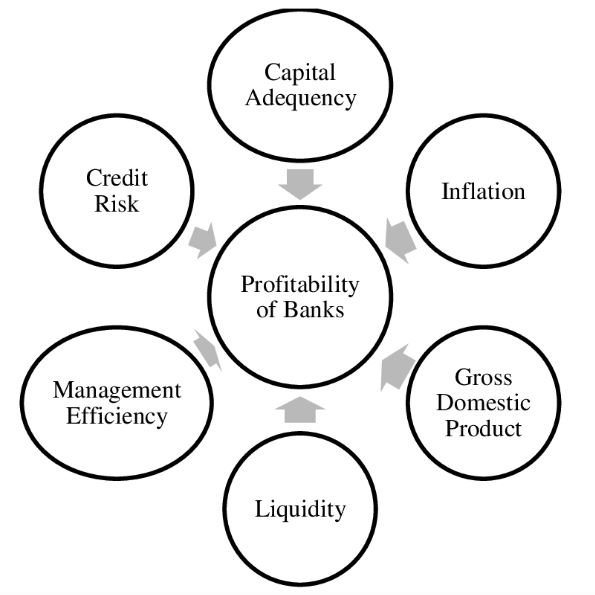

The banking sector has been blamed the most for the financial crisis that happened in the recent past. Therefore, it has been perceived to be very important to research and find the factors that affect the bank’s profitability so that the situation could be controlled in the cases of the financial crisis. In this context, this research explores the relationship of the factors such as liquidity, management efficiency, capital adequacy, the scale of operations, productivity of assets, growth in gross domestic product, and inflation with the return on equity. The primary aim of this dissertation is to explore the determinants of bank’s profitability in the South African region.

For this purpose, the research is aimed to find the crucial factors that affect the bank’s profitability in the South African region. Further, in this regards, the degree of influence of the factors on the bank’s profitability has also been evaluated in this dissertation. With regards to the research aim, the following objectives have been developed, which are to be addressed in this research:

- To review, research, and understand the regulatory framework prevailing in the South African region

- To study the bank system in South Africa through developed models and evaluate the factors, which contribute to the bank’s profitability

- To explore the determinants of bank’s profitability in the South African region

- 14,000 words – 48 pages in length

- Excellent use of literature

- Excellent analysis of subject area

- Well written throughout

- Ideal for finance and accounting students

1: Introduction

Background of the Research

Rationale for Doing the Research

Aim and Objectives

Research Question

Significance of the Research

Organisation of the Research

2: Literature Review

Bank Specific Factors Affecting the Profitability

Size of the Bank

Capital

Credit Risk Management

Product and Service Portfolio

Efficient Management Team

Liquidity Management

Industry or Sector Specific Factors

Banking Regulation in South Africa

Gross Domestic Product

Inflation

Prime Lending Rates

Taxation and Foreign Trade

3: Topic Description

4: Research Methodology

Research Question

Research Approach

Research Design

Data Collection Method

Selection and Justification

Sample Size and Sampling Strategy

Data Analysis Process and Tools

Ethical Considerations

Limitations of the Research

5: Data Analysis

Analysis of the CAMEL Ratios

Liquidity

Capital Adequacy

Efficiency

Non-Performing Loans

Net Interest Margin

Productive Asset Ratio

Size Ratio

Advance and Loans to Deposit Ratio

Analysis of the Gross Domestic Product

Analysis of the Inflation

6: Discussion

7: Conclusion

Brief Summary

Conclusion

Recommendations

References

Appendix